SAP Financials – FI Training

Omni Academy SAP Financial Accounting introduction program gives you a hands-on training which will help you to develop your expertise with SAP FI tips & tricks, learn exactly which functions and features are used in day-to-day business world get help from our certified SAP expert within the course. Course methodology will explains and demonstrates each important function of FICO module using SAP live server, lab-work, and practical theory. You do NOT need to have any previous experience with SAP as instructor will take you through from Beginner or Basic and make you highly comfortable with inner workings of SAP to increase you proficiency.

Adopt SAP consultancy as career?

If yes than you’re making a wise choice – SAP is the place to be. Interesting work, good money, amazing opportunities, great community. Here’s some key steps about selecting SAP as Career:

- Build up experience in your chosen field (Finance, Supply chain or HR)

- Do some SAP training (grasp the basics of SAP ERP Application)

- Apply for your related industry job (finance, supply chain or HR) in large organizations that you know are running SAP; in the interview tell them how interested you are in SAP, and that you’ve taken independent training

- Once employed, work your way into the SAP group by making your interest clear.

Course Key Modules

Module-1 SAP FI – General Ledger Accounting

Module-2 SAP FI – Accounts Payable Accounting Contents

Module-3 SAP FI – Accounts Receivable Accounting

Module-4 SAP FI – Cash & Bank

Module-5 SAP FI – Asset Accounting

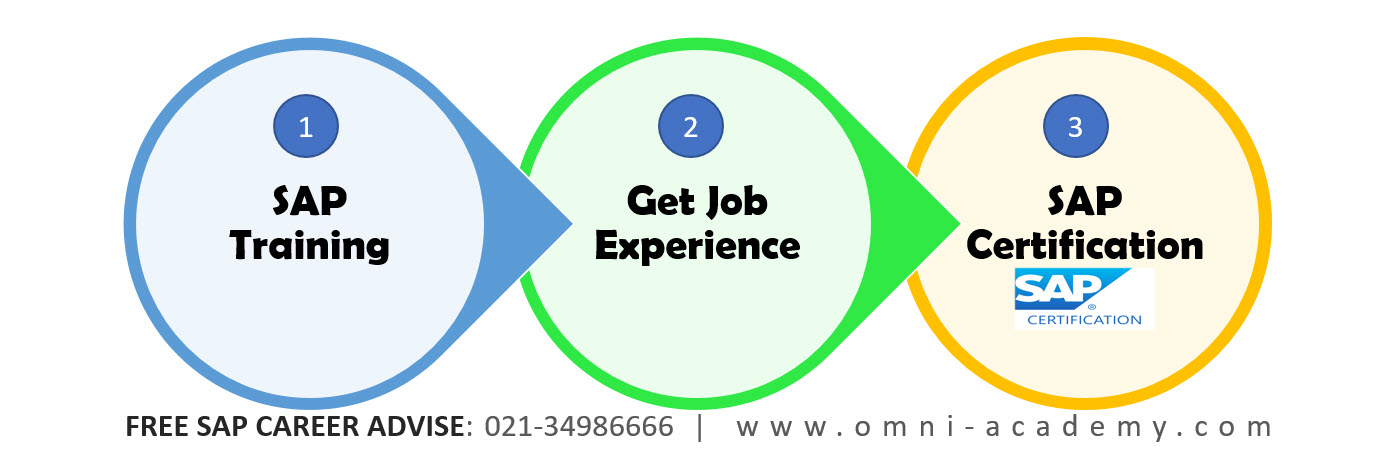

The Most Sensible Sequence is:

Learning Overview

- Learn SAP ERP Certification Exam Pattern

- Understand How Sap Financial Accounting Works

- Master The Basics Of Sap Financial Accounting

- Learn About Important Financial Accounting Terms

- The Importance Of The General Ledger And Learn About Key Features

- Learn About Sub-Ledgers, Accounts Receivable/Payable, Asset Accounting

- Overview Of How The Finance Module Integrates With Other Sap Modules

- Recognize The Organizational Elements Of R/3 And Describe The Basic Settings

- Be Able To Classify And Reconcile R/3 Documents With The Original Documents

- Learn About Opening And Closing Posting Periods

- Assign Posting Authorizations To Users

- SAP Certification Exam Tips

- SAP Certification Exam Practices Test Simulations Questions

Module-1 SAP FI-General Ledger Accounting

Contents

- Overview of the following

- Company Code

- Controlling Area

- Chart of Account

- Chart of Depreciation

- Document & Document Types

- Reconciliation Accounts in SAP

- Open Item Management in SAP

- Special GL Transactions

- Noted Items in SAP

- Posting Key

- Cost Centers & Profit Centers

- Posting Periods & Field Status Variant

- Payment Terms & Cash Discount

- Tolerance Group

- Prerequisites

- Master data of General Ledger Accounting

- Creation of Cost Centers

- Creation of Profit Centers

- Parking & Posting of General Ledger Account Documents

- Displaying a Parked & Posted Document

- Displaying & Changing General Ledger Account Document

- Posting of a Parked Document

- Deleting a Parked Document

- Reversal of a General Ledger Account Document

- Creating a General Ledger Recurring Document

- Displaying a Recurring Document

- Executing a Recurring General Ledger Account Document

Tasks to be done by Students:

- Create a New General Ledger Account in Chart of Account

- Create a New Profit Center

- Create a New Cost Center

- Park a General Ledger Account Document

- Display Ledger of General Ledger Account

- Display Parked Documents

- Post a Parked Document

- Reverse a General Ledger Account

- Carry out Recurring Entries in General Ledger.

Module-2 SAP FI – Accounts Payable Accounting Contents

- Overview of Accounts Payable

- Creating a Vendor Master Record

- Change Vendor Master Record

- Create Cheque Lots for House Bank

- Posting Vendor Down Payment Request

- Posting Vendor Down Payment

- Posting Vendor Invoices

- Down Payment Clearing

- Posting Vendor Credit Memo

- Posting Manual Outgoing Payments Through Cheque & Transfer

- Automatic Payment Program

- Making Partial Payments to Vendors

- Vendor Account Clearing

- Displaying Vendor Balance Report

Tasks to be done by Students:

- Create a New Vendor

- Post Down Payment Request

- Post Down Payment

- Post Vendor Invoice

- Clear Vendor Down Payment

- Post Vendor Credit Memo

- Process Manual Outgoing Payments Through Cheque & Transfer

- Run Vendor Balance Report

- Pay through Automatic Payment Program

- Clear Vendor Account

- Display Vendor Balances

Module-3 SAP FI – Accounts Receivable Accounting

Contents

- Overview of Account Receivable Accounting

- Creating a Customer Master Record

- Change Customer Master Record

- Posting Customer Down Payment Request

- Posting Customer Down Payment

- Posting Customer Invoices

- Down Payment Clearing

- Posting Customer Credit Memo

- Posting Incoming Payments

- Receiving Partial Payments from Customers

- Customer Account Clearing

- Displaying Customer Balance Report

Tasks to be done by Students:

- Create a Customer

- Post Customer Down Payment Request

- Post Customer Down Payment

- Post Customer Invoice

- Adjust Invoice against Down Payment Received

- Post Customer Credit Memo

- Clear Customer Account

- Display Customer Balances

Module-4 SAP FI – Cash & Bank

Contents

- Overview of Cash Journal

- Bank Key Master Data

- House Bank Master Data

- Cash Withdrawal from Bank

- Payment For Cash Expenses

- Advance Paid on Cash

- Overview of Banks in SAP

- Bank to Bank Transfer

- Bank Reconciliation

Tasks to be done by Students:

- Post Cash Receipt Transaction in Cash Journal

- Post Cash Expenses Transactions in Cash Journal

- Prepare Bank Reconciliation in Excel Sheet & Enter it in SAP.

- Execute Bank Reconciliation

Module-5 SAP FI-Asset Accounting

Contents

- Overview of Asset Accounting

- Asset Master Data Maintenance

- Sub Asset Maintenance

- Acquisition of Assets

- Retirement of Assets With Customer

- Retirement of Assets Without Customer

- Retirement of Assets Due to Scrapping

- Transfer of Assets

- Settlement of CWIP

- Reversing an Asset Document

- Depreciation Run

- Asset Report/ Asset Explorer

Tasks to be done by students:

- Create Asset

- Acquire Asset through Vendor

- Retire Asset to Customer

- Retire Asset Without Customer

- Run Asset Explorer

- Create a CWIP Asset

- Acquire CWIP Asset

- Retire an Asset Due to Scrapping

- Reverse an Asset Document

- Run Depreciation at the end.

Best Industry Focused Training & Certification Combination

- Experienced & Accredited SAP Trainers

- Accredited Training Material

- Includes SAP documentation manual

- Two FREE practice examinations

- Excellent first attempt pass ratio

Training Valuables

- Instructor Lead Training

- SAP Accredited Training Documentation

- Get a FREE Practice Exam Questions

- Graduates who have basic understanding of finance and financial terminology & want to learn FICO.

- SAP Functional Consultants who need a fundamental understanding of FI.

- SAP Technical Consultants and Developers who need a fundamental understanding of FI

SAP Job Market

SAP Job Interview Questions

- SAP FICO Job Interview Preparation

- SAP Hana Job Interview Preparation

- SAP SuccessFactor Job Interview Preparation

- SAP Basis Job Interview Preparation

- Job Interview Preparation (Questions & Answers)

SAP Course Useful Links

- SAP Certification Exam Registration Steps

- SAP Certification FEE – Blog

- SAP Certification Details – SAP Official

**Disclaimer**

- SAP is a registered trademark of SAP AG in Germany and many other countries.

- SAP software and SAP GUI are proprietary SAP software.

- You can officially get SAP Access to practice on SAP system from SAP’s website (Please google “SAP LIVE Access” or “External Virtual Desktop“)

International Students FEE and Exams

- International Students Online Training Fee : 1,000 USD | 3,750 SAR | 3,750 AED

- Functional or Technical Certification Fee – £350 (Each Module excluding VAT) – NOT included in Training Fee

Job Interview Preparation (Soft Skills Questions & Answers)

Stay connected even when you’re apart

👬🏻Join our WhatsApp Channel – Get discount offers

🧮 500+ Free Certification Exam Practice Question and Answers

Internships, Freelance and Full-Time Work opportunities

👫🏻 Join Internships and Referral Program (click for details)

👫🏻 Work as Freelancer or Full-Time Employee (click for details)

Flexible Class Options

- Week End Classes For Professionals SAT | SUN

- Corporate Group Trainings Available

- Online Classes – Live Virtual Class (L.V.C), Online Training